The Stablecoin Interoperability Problem: One Coin, Many Chains

Key Insights

Stablecoins are already moving trillions of dollars each year in real economic activity. Major stablecoins like USDT and USDC exist on many blockchains at once.

This “one coin, many chains” model creates fragmentation and failed payments.

Bridges help move value, but introduce cost, delay, and security risk. Without chain abstraction, stablecoins behave like isolated banking systems, not global money.

Solving interoperability is the key to unlocking everyday stablecoin payments at scale.

Introduction: Stablecoins Are Working — But the Infrastructure Isn’t There Yet

Stablecoins were created to solve a simple problem:

how to move money digitally without volatility.

They are pegged to fiat currencies like the US dollar and are now used for:

Payments

Remittances

Trading

DeFi

Treasury management

Today, stablecoins settle over $11 trillion annually, rivaling traditional payment networks. This makes them less of a crypto experiment and more of financial infrastructure.

But as adoption grows, a deeper issue is becoming impossible to ignore.

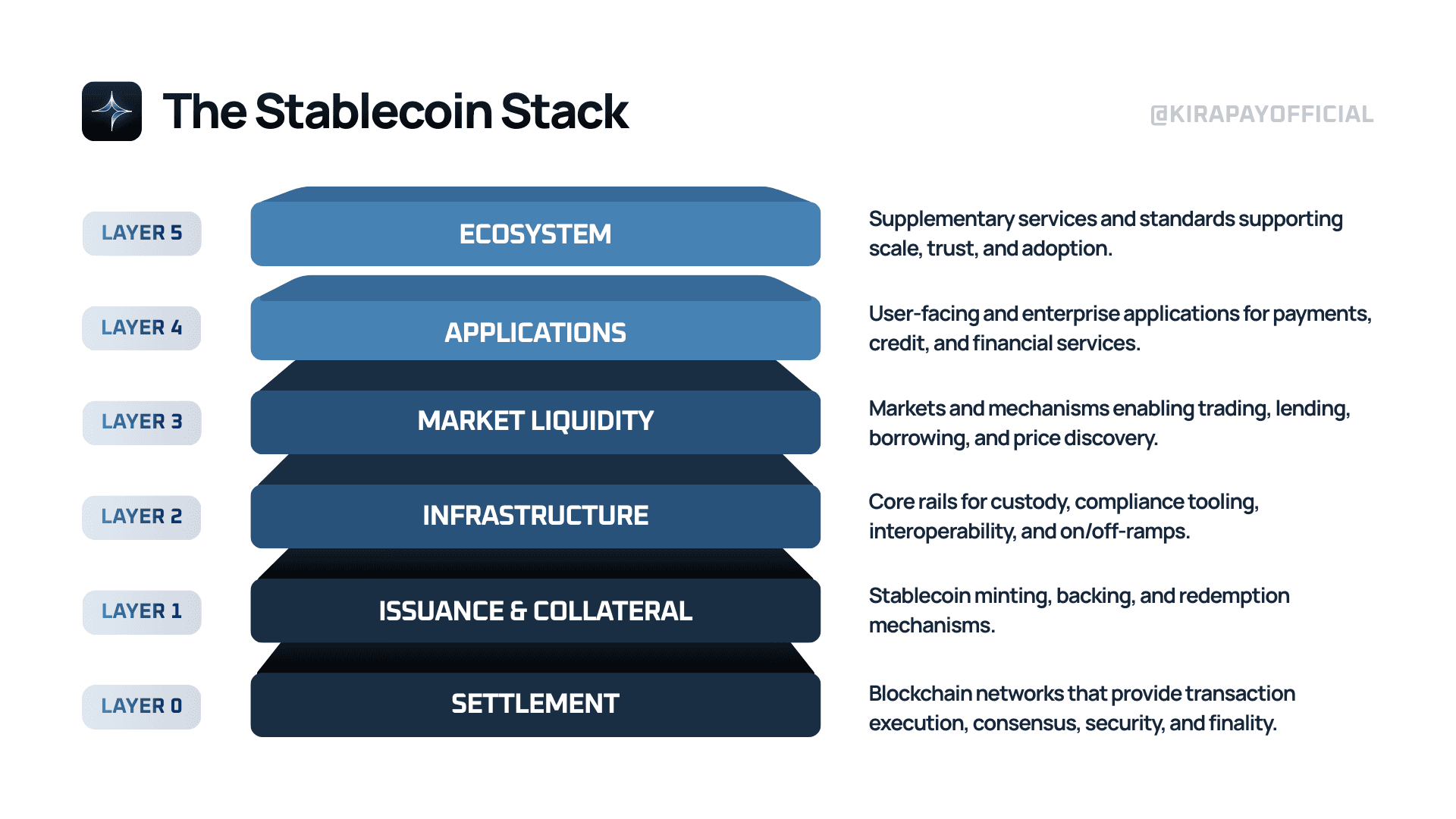

One Coin, Many Chains

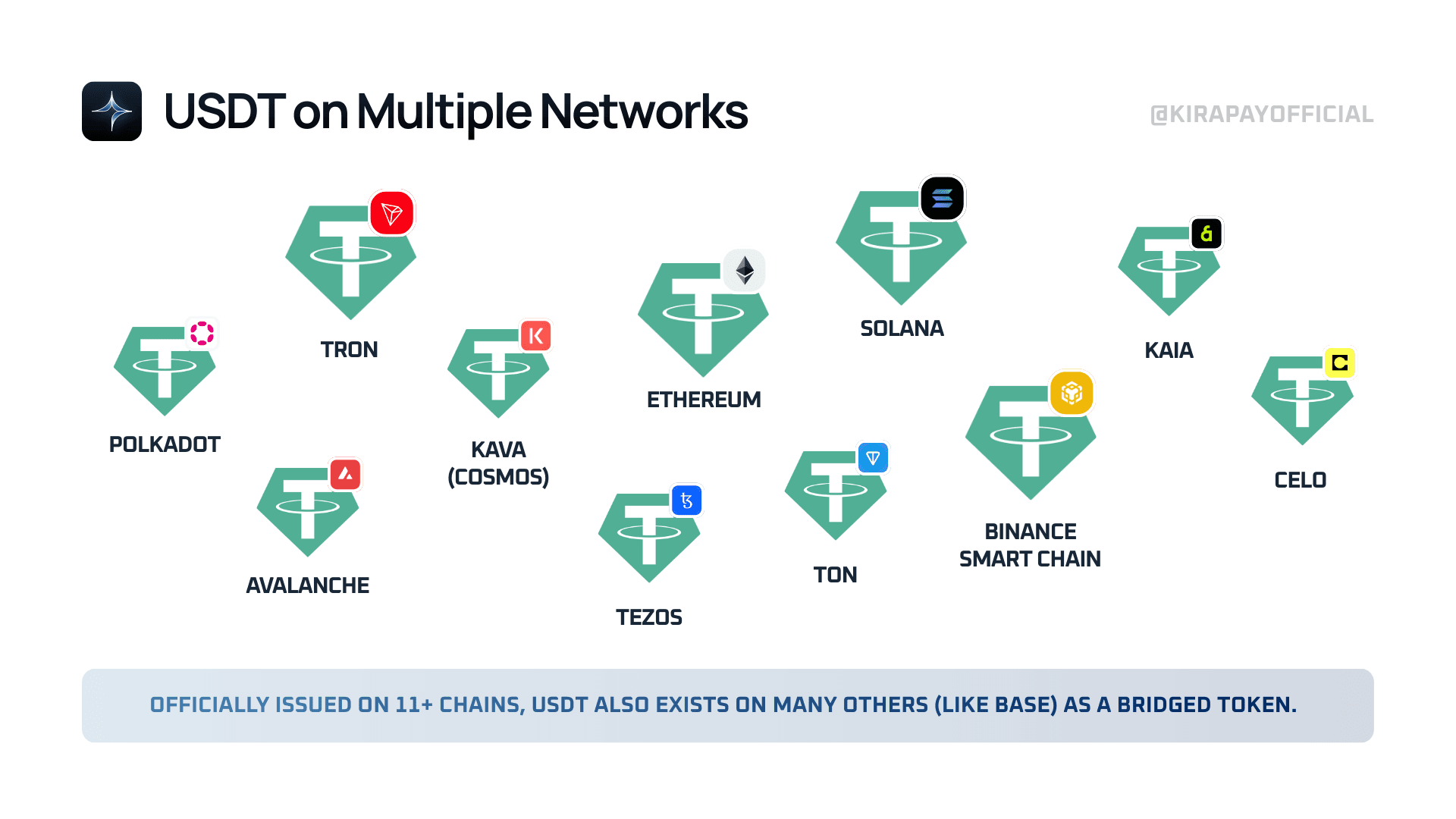

To reach more users and reduce dependency on a single network, stablecoin issuers deploy their tokens across multiple blockchains.

For example:

A bridged USDT on Base is a wrapped version of USDT, not a stablecoin natively issued by Tether.

It is created when USDT from another blockchain (most commonly Ethereum) is locked in a bridge, and a wrapped or mirrored token is minted on the Base network to represent that USDT.

While it functions like USDT for users — enabling faster and cheaper transactions on Base — it is a separate asset with a different contract, not directly redeemable with Tether, and its value depends on the security of the bridge holding the original USDT.

The Interoperability Problem Explained

Blockchain networks do not natively talk to each other.

So when the same stablecoin exists on different chains, value becomes trapped in liquidity silos.

To move funds between chains, users rely on:

Bridges

Wrapped tokens

Burn-and-mint mechanisms

This creates four major issues.

1. Fragmented Liquidity

USDT on Ethereum is not the same as USDT on Tron.

Liquidity becomes uneven:

Some chains are deep and liquid

Others are thin and isolated

This reduces efficiency and makes real-time payments harder.

2. Bridge Risk

Bridges are one of the most exploited components in crypto.

Over $2 billion has been lost to bridge hacks, with high-profile incidents proving that:

Extra validators

Oracles

Wrapped assets

All increase attack surface.

For payments, this risk is unacceptable.

3. High Costs and Delays

Cross-chain transfers often involve:

Gas fees on multiple networks

Waiting minutes or hours

Extra steps just to complete a payment

That might be acceptable for traders —

but not for checkout or remittances.

4. Compliance and UX Friction

Different chains often mean:

Repeated KYC

Different wallet behavior

Confusing error states

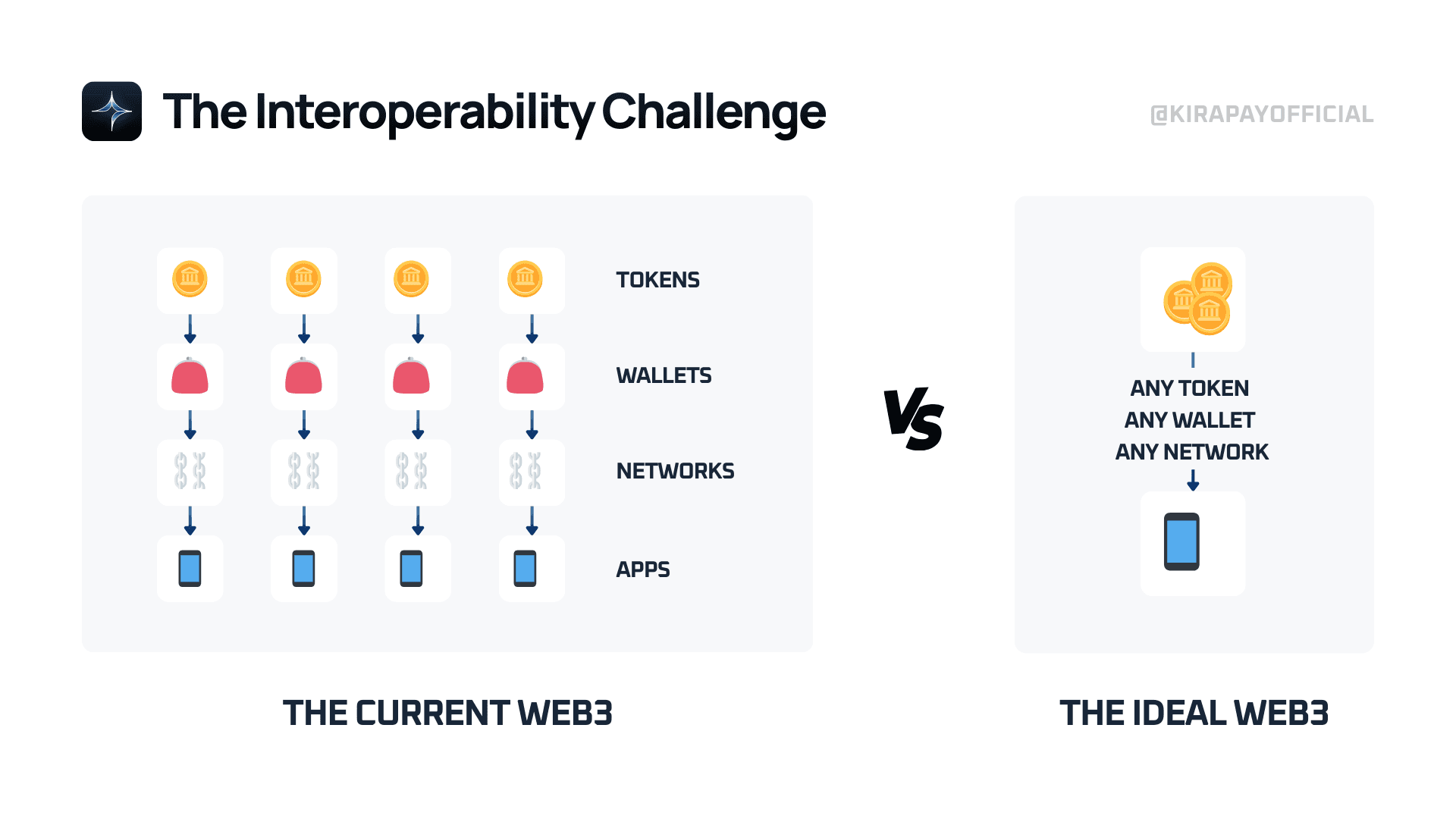

Instead of a global economy, stablecoins behave like disconnected banking systems.

Why This Limits Real-World Payments

Despite massive settlement volume, most stablecoin usage still happens inside silos.

Examples:

Payments fail when users hold tokens on the “wrong” chain

Remittances cost 1–5% due to routing and bridging

DeFi liquidity is split across ecosystems

Stablecoins should flow like email.

Instead, they behave like money locked in separate countries.

The Shift: From Interoperability as a Problem to an Opportunity

The industry is moving toward a new idea:

Users shouldn’t move assets across chains. Infrastructure should handle it for them.

We’re seeing progress through:

Native multi-chain issuance

Messaging standards

Aggregation layers

Chain abstraction approaches

The goal is not more bridges.

The goal is fewer decisions for users and merchants.

Where KIRAPAY Fits In

At KIRAPAY, we approach interoperability from a payments-first perspective.

Instead of asking users or merchants to manage chains, gas, or routing:

Users pay with any token, on any supported chain

KIRAPAY handles routing and execution behind the scenes

Merchants receive instant, predictable settlement on their preferred network

No bridges for users.

No retries.

No “wrong chain” failures.

That’s what chain-agnostic payments should look like in practice.

The Road Ahead

Stablecoin interoperability is no longer a niche technical issue.

It’s the difference between:

Stablecoins as trading tools

Stablecoins as everyday money

As more chains launch and more users come online, the winning systems will be those that:

Prioritize security

Reduce complexity

Respect user ownership

Abstract infrastructure from experience

Solve interoperability, and stablecoins become the internet of value.

Final Thought

Stablecoins already move trillions. The demand already exists.

What’s missing is infrastructure that lets value flow freely across chains, borders, and use cases.

One coin should feel like one coin. Everything else should be invisible.