Pay with Any Token. Anywhere. Instantly.

Pay with Any Token. Anywhere. Instantly.

Pay with Any Token. Anywhere. Instantly.

A cross-chain payment gateway

built for global interoperability.

Arbitrum

Avalanche

Base

BSC

Bitcoin

Ethereum

Polygon

Solana

Universal Support

Accept and settle payments instantly across ecosystems.

Trustless & Secure

Pyments go directly from buyer to merchant — you stay in control of your assets.

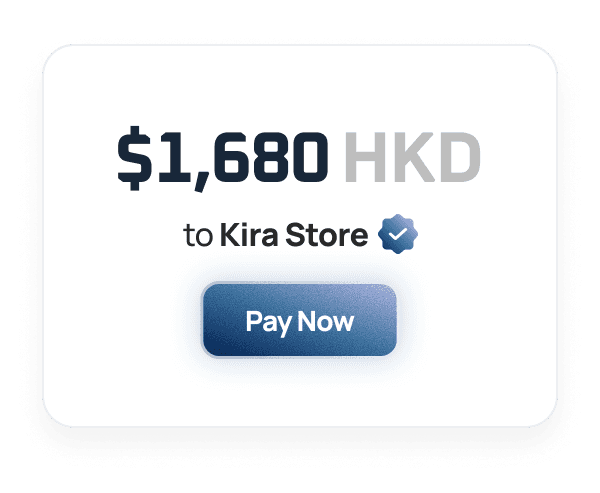

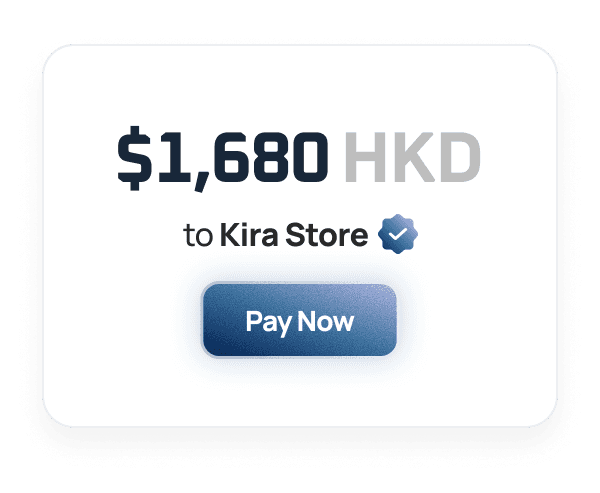

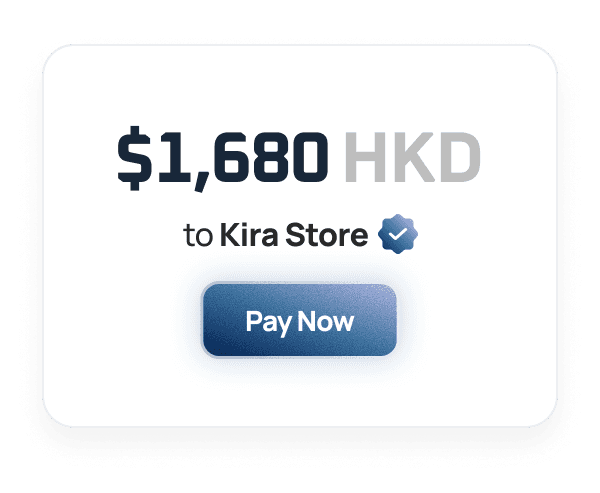

No-code Checkout

Anyone can create and share payment links, no developer needed.

Instant Payouts

Skip the 2–3 day wait — receive payments immediately on-chain.

Featured on

Product

Crypto Payments Without the Headaches

Product

Crypto Payments Without the Headaches

Product

Crypto Payments Without the Headaches

Every other crypto payment gateway å things complicated. Gas tokens, cross-chain swaps, hidden fees. KIRAPAY makes it easy.

Every other crypto payment gateway å things complicated. Gas tokens, cross-chain swaps, hidden fees. KIRAPAY makes it easy.

Every other crypto payment gateway å things complicated. Gas tokens, cross-chain swaps, hidden fees. KIRAPAY makes it easy.

Cross-Chain by Default

Accept payments from 20+ chains through one interface. No more telling customers “we only accept ETH or BTC” every chain just works.

Truly Universal

From e-commerce carts to SaaS subscriptions, donation forms to ticketing platforms — KIRAPAY adapts to any business model instantly.

From e-commerce carts to SaaS subscriptions, donation forms to ticketing platforms — KIRAPAY adapts to any business model instantly.

Built-In Fraud Protection

No chargebacks. No frozen funds. Every payment is final, verified, and under your control.

Flexible Payments

Accept payments from any crypto wallet, credit/debit card, or bank transfer. KIRAPAY makes it simple for anyone to pay, whether they’re in Web2 or Web3

FAQ

All You Need to Know

FAQ

All You Need to Know

FAQ

All You Need to Know

BETA Access

What is the KIRAPAY Beta?

Who can join the Beta?

How do I access the Beta?

How does KIRAPAY ensure transaction safety?

Where can developers start building?

What is the KIRAPAY Beta?

Who can join the Beta?

How do I access the Beta?

How does KIRAPAY ensure transaction safety?

Where can developers start building?

What is the KIRAPAY Beta?

Who can join the Beta?

How do I access the Beta?

How does KIRAPAY ensure transaction safety?

Where can developers start building?

For Merchants

What is KIRAPAY?

Do customers need to pay gas fees?

What are the fees?

Can I use KIRAPAY for subscriptions or recurring payments?

How do I get started?

Are my funds safe?

What is KIRAPAY?

Do customers need to pay gas fees?

What are the fees?

Can I use KIRAPAY for subscriptions or recurring payments?

How do I get started?

Are my funds safe?

What is KIRAPAY?

Do customers need to pay gas fees?

What are the fees?

Can I use KIRAPAY for subscriptions or recurring payments?

How do I get started?

Are my funds safe?

For Customers

Do my customers need to understand crypto?

Do my customers need to understand crypto?

Do my customers need to understand crypto?

Do customers need to pay gas fees?

Do customers need to pay gas fees?

Do customers need to pay gas fees?

What happens if a payment fails?

What happens if a payment fails?

What happens if a payment fails?

Blog

Insights & Updates

Blog

Insights & Updates

Blog

Insights & Updates

We’re Live! KIRAPAY 1.0 is Officially Here

Today marks a milestone we’ve been dreaming of and working toward for months. KIRAPAY 1.0 is officially live! First and foremost—thank you.

We’re Live! KIRAPAY 1.0 is Officially Here

Today marks a milestone we’ve been dreaming of and working toward for months. KIRAPAY 1.0 is officially live! First and foremost—thank you.

We’re Live! KIRAPAY 1.0 is Officially Here

Today marks a milestone we’ve been dreaming of and working toward for months. KIRAPAY 1.0 is officially live! First and foremost—thank you.

The KIRAPAY Trajectory — Q4 2025

Groundwork in Q4, Growth Across Ecosystems in 2026 Q4 was about getting KIRAPAY into the hands of real builders. 2026 is about scaling what worked.

The KIRAPAY Trajectory — Q4 2025

Groundwork in Q4, Growth Across Ecosystems in 2026 Q4 was about getting KIRAPAY into the hands of real builders. 2026 is about scaling what worked.

The KIRAPAY Trajectory — Q4 2025

Groundwork in Q4, Growth Across Ecosystems in 2026 Q4 was about getting KIRAPAY into the hands of real builders. 2026 is about scaling what worked.

The Stablecoin Interoperability Problem: One Coin, Many Chains

Stablecoins are already moving trillions of dollars each year in real economic activity. Major stablecoins like USDT and USDC exist on many blockchains at once.This “one coin, many chains” model creates fragmentation and failed payments.

The Stablecoin Interoperability Problem: One Coin, Many Chains

Stablecoins are already moving trillions of dollars each year in real economic activity. Major stablecoins like USDT and USDC exist on many blockchains at once.This “one coin, many chains” model creates fragmentation and failed payments.

The Stablecoin Interoperability Problem: One Coin, Many Chains

Stablecoins are already moving trillions of dollars each year in real economic activity. Major stablecoins like USDT and USDC exist on many blockchains at once.This “one coin, many chains” model creates fragmentation and failed payments.